Social Links

ACTION ALERT – Urge Senate to Support Public School Students by Adequately Funding Our Schools

ACTION ALERT – Tell Congress to Push Back Against Executive Overreach

RESOURCES

Resources from NEA

- Teacher Appreciation Week

- Resources for Teaching About Indigenous Peoples

- Student and Educator Mental Health

- Safe School Communities

- School Gun Violence Prevention and Response Guide

- Context for Teaching Students with Autism

Read Across America

- Video recordings – Watch OEA-R and OEA members celebrate Read Across America by reading books

- Create and Celebrate a Nation of Diverse Readers – resources from NEA

Ohio Schools Magazine digital editions

- June/July 2025

- April/May 2025

- February/ March 2025

- December 2024/ January 2025

- October/ November 2024

- 2024-2025 Member Resource Guide

- Ohio Schools archive

PRESS RELEASES

- June 26, 2025 – OEA urges governor to veto budget items

- June 24, 2025 – Ohio Education Association celebrates court decision ruling Ohio’s vouchers unconstitutional

- May 22, 2025 – Thousands of free books distributed to Lima-area students at Ohio Education Association’s Summer Celebration of Diverse Readers

- May 12, 2025 – OEA members elect new President and Vice President

- April 1, 2025 – House Budget Disregards Educational Future of Majority of Ohio’s Children

- March 26, 2025 – All In For Ohio Kids Launches New Tool Showing Impact of Fully Funded Fair School Funding Plan

- March 20, 2025 – President Trump’s Executive Order on Department of Education

- Press Release Archive

LEGISLATIVE WATCH RELEASES

- June 13, 2025 – Senate Passes Budget Bill Setting Stage for Conference Committee; Stand with Ohio Higher Education: Help Repeal SB1 – Sign, Volunteer, Donate; Next week at the General Assembly

- June 6, 2025 – Senate Substitute Budget Bill Misses the Mark on Fair School Funding; Advocates Host Townhall on the Impact of Federal Medicaid Cuts; Next week at the General Assembly

- May 30, 2025 – Election Bill Draws Broad Opposition; Policy Matters Ohio to host virtual town hall on defending Medicaid, including critical school-based services like CHIP; Next week at the General Assembly

- May 23, 2025 – OEA Members Advocate at the Statehouse for Fair School Funding and Respect for Educators’ Voice; Immigration Status Reporting Bill Raises Alarms for Public Schools

- May 20, 2025 – Senate Education Committee Deliberation of State Budget Concludes; Congressional Recess: Schedule Your Member Meetings

- Legislative Watch Archive

- Legislative Scorecard – An interactive Legislative scorecard for each member of the Ohio General Assembly

EVENTS – or visit the Master Calendar

- July 21 – OEA-Retired Racial and Social Justice Committee Book Study

- August 18 & September 15 – OEA-Retired Racial and Social Justice Committee Book Study

PUBLIC EDUCATION MATTERS PODCAST

Subscribe and Listen to Public Education Matters on a variety of podcast networks

Transistor RSS feed | Apple podcasts | Listen on YouTube | Spotify | Amazon music

- Season 5, Episode 1 – New school year brings new trends, challenges, and opportunities

- Season 5, Episode 2 – For Sen. Sherrod Brown’s family, supporting public education is a shared mission

- Season 5, Episode 3 – Rhonda Johnson for State Board of Education

- Season 5, Episode 4 – The top NEA Member Benefits deals you can’t afford to miss

- Season 5, Episode 5 – OEA Members: Send Rep. Joe Miller (D-District 53) back to the Statehouse!

- Season 5, Episode 6 – Rep. Justin Pizzulli (R-District 90): ‘I want to be a voice for the voiceless’

- Season 5, Episode 7 – State Bd. of Ed. candidate Chris Orban’s work to transform how math, computer science are taught in Ohio

- Season 5, Episode 8 – Three big things every Local should include in their next contract (Plus, one big reason to visit ohea.org)

- Season 5, Episode 9 – Rep. Sean Patrick Brennan (D-14): ‘Educators, know your power!’

- Season 5, Episode 10 – Military veterans, are you getting the credit you’re owed for your years of service?

- Season 5, Episode 11 – Meet OEA’s new Secretary-Treasurer

- Season 5, Episode 12 – How the Kent State AE chapter co-president’s past is shaping her future as an educator

- Season 5, Episode 13 – How the 2025 Ohio Teacher of the Year rediscovered her passion for teaching

- Season 5, Episode 14 – Stop SB 295 – Why Ohio lawmakers must not repeat the failed policies of the past and what they need to do instead

- Season 5, Episode 15 – AI and Digital Tools in the Classroom

- Season 5, Episode 16 – Celebrating 40 years of legally protected collective bargaining in Ohio

- Season 5, Episode 17 – The growing demand for Career Tech Education in Ohio

- Season 5, Episode 18 – Aspiring Educator Kyndal Mickel aspires to serve neurodivergent learners like herself

- Season 5, Episode 19 – OEA-R member Marti Franks on the past and future of union activism

- Season 5, Episode 20 – Bipartisan panel of Ohio lawmakers talks big education issues for new General Assembly

- Season 5, Episode 21 – Register now: NPE/NPE Action bringing some of the biggest names in education to Columbus with national conference in April

- Season 5, Episode 22 – Stepping Up to Lead an ESP Local

- Season 5, Episode 23 – Giving new Local leaders the tools to succeed

- Season 5, Episode 24 – Stand Up Against SB 1

- Season 5, Episode 25 – Celebrating Music in Our Schools

- Season 5, Episode 26 – Akron ESPs try new events, strategies to engage community & members

- Season 5, Episode 27 – Michelle Obama said ‘Do More’—So this educator ran for office. Now, he wants you to run, too.

- Season 5, Episode 28 – Licking Heights educators to Ohio lawmakers: ‘Keep your promise to fully and fairly fund our public schools”

- Season 5, Episode 29 – Mason educator shares lessons in Building Stories and Building Bridges

- Season 5, Episode 30 – For Educators by Educators: Ohio Educator Standards Bd. rolls out new Professional Learning Standards

- Season 5, Episode 31 – How OEA members – and their families – can get big discounts on online college & certification courses

- Season 5, Episode 32 – Creating pay equity for Career Tech Educators

- Season 5, Episode 33 – Finding their voice: How ACCESS emerged from a bargaining crisis stronger than ever

- Season 5, Episode 34 – Celebrating Diverse Readers in Lima and Diversity Read-Ins in Twinsburg

- Season 5, Episode 35 – VFW’s Ohio HS Teacher of the Year brings lessons in citizenship outside the classroom

- Season 5, Episode 36 – Urgent Legislative Update: The threats to public education and the opportunities to act now

- Season 5, Episode 37 – Turning the page: Scott DiMauro reflects on OEA presidency, education career, and what’s ahead

- Season 4, Episode 1 – Speaking in a united voice because Public Education Matters. Plus, the OEA app.

- Season 4, Episode 2 – Kids Voting Ohio. Plus, Running for Westerville City Council

- Season 4, Episode 3 – On Our Sleeves. Plus, celebrating Public Education Matters Day

- Season 4, Episode 4 – Educators belong on local school boards. Plus, OEA’s Legislative Scorecard

- Season 4, Episode 5 – Supporting student stewards of our democracy. Plus, OEA’s Affiliate Grant Programs

- Season 4, Episode 6 – Meeting the needs of growing numbers of English Learners. Plus, OEA Nights with the Cavs and Blue Jackets.

- Season 4, Episode 7 – The 2024 OTOY’s journey from the newsroom to the classroom. Plus, OEA member deals on grad credit hours.

- Season 4, Episode 8 – Practical guidance for building positive family engagement. Plus, bringing OEA’s Aspiring Educators together.

- Season 4, Episode 9 – Creating welcoming P.E. classes for every student – no exceptions. Plus, new resources for OEA members to hold legislators accountable.

- Season 4, Episode 10 – Rolling out Ohio’s dyslexia policies. Plus, OEA’s Educational Foundation grants.

- Season 4, Episode 11 – Elevating Education Support Professionals’ voices. Plus, OEA’s Ohio Schools magazine goes digital.

- Season 4, Episode 12 – See Educators Run. Plus, OEA’s continued fight against SB 83

- Season 4, Episode 13 – NPE report gives Ohio failing grade on state’s support for public education. Plus, OEA members talk banned books.

- Season 4, Episode 14 – Educators serving as DNC delegates. Plus, fun opportunities to support the OEA Fund.

- Season 4, Episode 15 – 5 things you didn’t know about OASNP. Plus, MCTA’s PD Day success.

- Season 4, Episode 16 – When THAT Student Becomes the Teacher: A neurodiverse educator’s perspective. Plus, advocating for Developmentally Appropriate Practice in early childhood education

- Season 4, Episode 17 – Storytelling as an Organizational Tool. Plus, Sandy Smith Fischer for STRS

- Season 4, Episode 18 – Erase the Space. Plus, meet OEA’s NEA fellow.

- Season 4, Episode 19 – Vouchers hurt educators’ pensions. Plus, OEA support of the One Fair Wage campaign

- Season 4, Episode 20 – Amplifying immigrant students’ voices. Plus, OEA celebrates diverse readers in East Cleveland.

- Season 4, Episode 21 – Citizens Not Politicians aims to end gerrymandering in Ohio. Plus, OEA members’ power to shape our state’s future.

- Season 3, Episode 1 – Celebrating Our Wins

- Season 3, Episode 2 – Ohio Parents Trust Teachers

- Season 3, Episode 3 – The Hard Choice to Walk Away

- Season 3, Episode 4 – Choosing the OEA Member-Recommended Candidates

- Season 3, Episode 5 – “The Kindness Machine”

- Season 3, Episode 6 – Educators on the Ballot

- Season 3, Episode 7 – State Supreme Court Candidate Spotlight

- Season 3, Episode 8 – Supporting Diverse Educators

- Season 3, Episode 9 – The Case Against Mandatory Retention Under the 3rd Grade Reading Guarantee

- Season 3, Episode 10 – A Legacy of Education: The Jessens

- Season 3, Episode 11 – A Legacy of Education: Sandra Dowdy & Calista Altenburger

- Season 3, Episode 12 – Ohio Teacher of the Year Melissa Kmetz

- Season 3, Episode 13 – What’s next for the NEXUS pipeline school funding?

- Season 3, Episode 14 – Standing Together for Education

- Season 3, Episode 15 – A Legacy of Education: Jillian Majzan & Stephanie Hall

- Season 3, Episode 16 – Remembering OEA Awards & Scholarship namesakes

- Season 3, Episode 17 – Working to Repeal GPO/WEP

- Season 3, Episode 18 – Bringing Special Needs Professionals Together

- Season 3, Episode 19 – The ABC’s of CEA’s Larry Carey

- Season 3, Episode 20 – The Columbia Giving Tree

- Season 3, Episode 21 – ‘Where there’s a will, there’s a way’

- Season 3, Episode 22 – Beyond the Headlines: Cleveland’s Promise

- Season 3, Episode 23 – The Ohio Children’s Budget Coalition’s Vision of Child Wellbeing

- Season 3, Episode 24 – Supporting HBCUs and future educators of color

- Season 3, Episode 25 – Hunger-Free Schools Ohio: Expand meal access for all now

- Season 3, Episode 26 – Arthur Lard for STRS

- Season 3, Episode 27 – Brothers RISE

- Season 3, Episode 28 – #columbusstudentsdeserve: Six months after the CEA strike

- Season 3, Episode 29 – DeRolph, 26 years later

- Season 3, Episode 30 – From the classroom to the Mansfield mayor’s office?

- Season 3, Episode 31 – Senate Bill 83: Bad for students, bad for higher education, bad for Ohio

- Season 3, Episode 32 – Echoes and Reflections: Improving Holocaust education in Ohio

- Season 3, Episode 33 – Ohio’s schools by the numbers: Policy Matters research examines funding, discipline, absenteeism, and more

- Season 3, Episode 34 – Natasha Hurt-Hayes, Education Champion

- Season 3, Episode 35 – Preparing for a Summer Celebration of Diverse Readers

- Season 3, Episode 36 – Vote NO in August

- Season 3, Episode 37 – A Legacy of Education: The Johnsons

- Season 3, Episode 38 – Retiree answers the call to return to the classroom

- Season 3, Episode 39 – Council on American-Islamic Relations offers new Educator Resource page

- Season 3, Episode 40 – Public Education Matters because…

Oh Yes, We’re Social — Join the Conversation!

Updated June 24, 2025

June 2022 OEA Retirement Systems Update

ORSC Reviews Retirement Systems’ Investment Performance

The Ohio Retirement Study Council (ORSC) is a legislative body that provides oversight for Ohio’s public retirement plans. On May 12, 2022, the ORSC received a review of the pension systems’ investment performance by Jim Voytko, president of RVK, the council’s investment consultant.

The results showed very strong returns, net of fees, for OPERS, SERS, and STRS over the 2021 calendar year. During this period, STRS posted the highest return with 19.24%, followed by SERS with 17.13% and OPERS with 15.34%. Below is a chart that shows the net return for each of the three systems over a one, three, five, seven, and 10-year period.

| System | 1 year | 3 years | 5 years | 7 years | 10 years |

| OPERS | 15.34 | 14.84 | 11.41 | 9.32 | 10.08 |

| SERS | 17.13 | 15.48 | 11.99 | 9.89 | 10.48 |

| STRS | 19.24 | 16.51 | 12.42 | 10.30 | 11.04 |

Compared to pension plans across the United States, the Ohio systems performed better than most public plans with at least $1 billion in assets. These comparisons were made on gross returns because net return data is not available for all funds.

ORSC Chair Representative Phil Plummer (R- Dayton) asked Voytko to respond to concerns that STRS investment performance is particularly bad. He responded that there is no data to support those claims. “If you look at their performance versus their benchmarks…they have done well. And if you look at their returns against a large number of other public pension plans, they rank anywhere from the top quartile to top decile,” Voytko said. “There’s no number here in any form that would lead me to that conclusion” that STRS had performed badly.

2021 Investment Returns Improve OPERS Funding Status

At the May OPERS Board meeting, OPERS staff gave a review of the system’s 2021 investment returns and funding status. The OPERS Defined Benefit portfolio posted an investment return of over 15% for 2021. The overall funding of the pension plan improved from 82% to 84%.

The funding period of the pension plan represents the amount of time it would take to pay off the unfunded liabilities (reach 100% funded) if all current assumptions were met. Based on the financial status of the plan at the end of calendar year 2021, the funding period of the OPERS plan was 16 years. This represents an improvement from a funding period of 21 years at the end of 2020.

![]() Click here to download a copy of this June 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this June 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

May 2022 OEA Retirement Systems Update

STRS Board Increases Health Care Subsidies for Retirees and Makes Plan Improvements

At its April meeting, the STRS Board approved an increase in health care premium subsidies for retirees and made several improvements to the health care program. These changes will lower costs for STRS retirees. Plan changes will go into effect on January 1, 2023.

The Board voted to increase the premium subsidy to 2.2% per year of service from 2.1% per year of service (up to 30 years maximum). For retirees with 30 or more years of service this means that STRS would pay 66% of the monthly premium, up from 63%. Additionally, the current Medicare Part B reimbursement will be converted to a premium credit of $30 and will now be applied to eligible surviving spouses who do not currently receive the reimbursement.

Changes in plan design include: a decrease in the maximum out-of-pocket drug costs to $4,000 from $5,100; improvement to the primary care physician copay in the Medical Mutual and Aetna Basic plans to a $20 copay for each visit; and a change in the pharmacy network that will reduce costs by $2.4 million a year. Savings from the change in the pharmacy network will be used to lower member premiums.

Health care premiums will be approved at the June meeting. However, initial estimates show over a 14% reduction in the premium for the Aetna Medicare Advantage plan and a slight increase of 1% in the most popular plan for pre-65 retirees. When factoring in the change in subsidies, a retiree with 30 or more years of service is projected to pay $23 less a month in the Medicare Advantage plan and $30 less a month in the most popular pre-Medicare plans.

SERS to Extend Health Care Contracts

SERS to Extend Health Care Contracts

At its March meeting, the SERS Board approved recommendations to extend contracts with Aetna to provide Medicare Advantage PPO and non-Medicare services to SERS retirees. Buck consulting, which reviewed SERS medical plans, concluded that the current program structure was financially positive, and that SERS should re-negotiate with the provider for cost savings. SERS is expected to realize $21.5 million in savings over the length of a new five-year contract. Additionally, Aetna agreed to no increase in administrative fees for the duration of the contract.

At its April meeting, the SERS Board directed staff to negotiate a new three-year contract with Express Scripts to provide pharmacy management services. Express Scripts has provided these services to SERS since 2008 and offered the lowest net pricing of five respondents to a request for proposals.–

![]() Click here to download a copy of this May 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this May 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

March 2022 OEA Retirement Systems Update

VICTORY: STRS Board Votes to Pay a 3% COLA, Improves Retirement Eligibility

On Thursday, March 17, 2022, the STRS Board voted to approve a 3% cost-of-living adjustment (COLA) to eligible retirees for the 2022-2023 fiscal year and remove the age 60 requirement for retirement eligibility with full benefits that was scheduled to take effect in 2026. OEA members on the STRS Board championed these changes and OEA and its members have advocated for them. OEA welcomes this action that benefit both active and retired teachers in the system.

After the Great Recession, the STRS fund was projected to run out of money. This required changes for both active and retired members to improve the funding status of the plan so that reliable benefits would continue to be available for all current and future retirees. Because of the stewardship of OEA members on the STRS Board, the fund is in a healthier financial position, enabling the restoration of some benefits now.

The cost-of-living adjustment of 3% will be calculated on a retiree’s base benefit and will be added to each monthly payment beginning on their anniversary date during the next fiscal year (July 1, 2022 – June 30, 2023). Under Ohio law, STRS members who have been retired for 60 months are eligible for the COLA. STRS Board member Rita Walters proposed costing out a COLA amount of 3% rather than 2%. The STRS actuary stated that this change coupled with the change in retirement eligibility would not materially impair the fiscal integrity of pension leading to its approval by the Board.

The change in retirement eligibility will provide some needed relief to teachers who saw their possible retirement date pushed out by seven or eight years by pension reform legislation. Under current law, in addition to being eligible to retire at age 65 with at least five years of service, STRS members are eligible to retire with 34 years of service at any age. On August 1, 2023 through July 1, 2026 eligibility will be 35 years of service at any age. Prior to this change by the Board, a requirement of having 35 years of service and being at least age 60 was set to go into effect August 1, 2026 and thereafter. The Board removing the age 60 requirement means that the eligibility for full benefits with 35 years of service and beyond will be in effect from August 1, 2023 and thereafter.

STRS Board Election is Approaching: OEA Recommends McFee, Rhodes and Walters

There is an important election for the STRS Board coming up. OEA’s recommended candidates are Robert McFee and Jeffrey Rhodes for two seats on the Board representing active members and Rita Walters for a seat representing STRS retirees. Each of them currently serve on the STRS Board and are seeking re-election. As demonstrated by their time on the Board and by their recent vote on benefits, they are committed to ensuring the long-term stability of our pension plan as well as restoring benefits for active and retired teachers when finances of the fund allow.

Rita Walters, Robert McFee, and Jeffrey Rhodes were selected as OEA’s member-recommended candidates for the STRS Board seats based on a screening interview by OEA active and retired members and a vote of the OEA Board of Directors. They are proven leaders who are looking out for the best interests of their fellow educators. Ballots will be mailed out in early April, with all active employees – those currently paying into STRS – eligible to vote for the active seats; retired OEA members are eligible to vote for the retired seat.

OPERS Reports 15.3% Investment Return in 2021

OPERS Reports 15.3% Investment Return in 2021

The Ohio Public Employees Retirement System (OPERS) received an investment return of 15.3% for the pension fund during the 2021 calendar year. The pension fund ended the year with $109.3 billion in assets.

OPERS has an annualized investment return of 14.9% for the past three years, 11.4% for the past five years, and 10.1% for the past ten years.

The investment return for the OPERS health care fund was 14.3% for calendar year 2021. The health care fund has a different asset allocation than the pension fund based on taking on less risk due to the expected solvency of the fund. The health care fund ended 2021 with $14.5 billion in assets.–

![]() Click here to download a copy of this March 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this March 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

February 2022 OEA Retirement Systems Update

OEA Endorses McFee, Rhodes and Walters for STRTS Board

The OEA Board of Directors has endorsed three candidates for the STRS Board. Robert McFee and Jeffrey Rhodes are seeking re-election to the STRS Board as representatives of active members. Rita Walters is seeking re-election to the Board as a retiree representative.

As Board members, these candidates and OEA members have been dedicated to improving the funding status of the pension plan to make pension benefits more secure for all members. Over the past four years, the funding ratio of the pension plan has improved significantly. The STRS Board is now able act on resumption of the cost-of-living adjustment (COLA) for retirees coupled with improvements for active teachers.

Robert McFee and Jeffrey Rhodes (active seats)

Robert McFee is a math teacher in the Willoughby Eastlake City Schools. Jeffrey Rhodes is an Industrial Education teacher in North Royalton City Schools. Both have served on the Board since 2018.

Rita Walters (retiree seat)

Rita Walters retired with 35 years of experience as a classroom teacher with Switzerland of Ohio Schools. As an active teacher, she served as president of her local association and on the OEA Board of Directors for 12 years. Walters was elected to the STRS Board in 2017.

- Improving Funding

After the Great Recession, STRS was projected to run out of money. Since McFee, Rhodes, and Walters have been on the Board, STRS funding has greatly improved making our future pensions benefits more secure and reliable. - Restoring Benefits

Improved funding means that STRS is now able to begin restoring benefits. McFee, Rhodes, and Walters believe this must benefit all STRS members—active and retired. In addition to bringing back a COLA for retirees, active teachers should benefit from an earlier retirement age (removing the age 60 requirement). - Securing Health Care

Once projected to run out of money, the STRS Health Care program is now fully funded, and retirees have received premium rebates for the past two years. - Protecting Our Pension

Recently, two STRS Board members proposed investing up to $65 billion (2/3 of STRS assets) in a firm with no clients and no track record of success. Our endorsed candidates will fight against unproven investment schemes targeting our pension dollars.

In early April, ballots will be sent to all STRS members. Active employees, those currently paying into STRS are eligible to vote in the election for the active member seat. STRS retirees, are eligible to vote in the election for the retiree seats.

OEA’s endorsed candidates for the STRS Board are proven leaders who are looking out for the best interests of their fellow educators. These three candidates are dedicated to improving benefits for active and retired teachers while ensuring that the pension plan is sustainable into the future.

We need to do everything we can to re-elect Robert McFee, Jeffrey Rhodes, and Rita Walters to the STRS Board

OEA Urges COLA Payment, Removal of Age 60 Requirement at STRS

At the February meeting of the STRS Board, OEA Secretary-Treasurer Mark Hill addressed the Board to advocate for restoration of cost-of-living adjustment (COLA) payments for retirees coupled with changes benefiting active teachers. Specifically, he voiced OEA’s support for options that would pay a 2% COLA for eligible retirees coupled with removal of the age 60 requirement for retirement eligibility. This would allow unreduced benefits with 35 years of service at any age from August 2023 and beyond. A second supported option would include those two items and a 1% decrease in the employee contribution rate from 14% to 13%. A copy of the statement is attached.

The improved funding level of the pension plan make these recommended benefit improvements possible. In 2017, the STRS pension plan did not meet the requirement in Ohio law that period needed to pay off the unfunded liabilities of the system cannot exceed 30 years. The STRS Board voted to suspend COLA payments to shore up the long-term funding of the pension plan. The Board stated that they would review the change within five years and subsequently adopted a funding policy to consider changes that do not impair the fiscal integrity of the pension plan once the plan was 85% funded.

Given the strong investment returns of last fiscal year (over 28%) and due to the shared sacrifice of both active and retired members, STRS is now over 85% funded on a market basis. OEA believes that both active and retired teachers should benefit from this improved funding status. The proposed changes can be afforded without putting the long-term solvency of the system in jeopardy.

The STRS is expected to vote on possible changes at its March meeting. The Board will examine the proposals outlined above as well as the possibility of a multi-year COLA or a COLA of 3%–

![]() Click here to download a copy of this February 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this February 2022 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

December 2021 OEA Retirement Systems Update

STRS Funding Level Improves

During its October meeting, the STRS Board received the results of the actuarial valuation of the pension plan. As of the end of fiscal year 2021 (June 30), the pension plan was 80.1% funded. This is an improvement from 77.4% the previous year. Very strong investment returns during the period were largely responsible for the improved funding.

Not all of the investment gain of FY 2021 is reflected in the actuarial valuation because gains and losses are smoothed over a four-year period. Using the market value of assets, the funding ratio is 87.8%. This is significant as the STRS Board policy says that they will consider benefit improvements that do not impair the fiscal integrity of the pension at 85% funding.

It would be unwise to make permanent changes based on one year of investment returns. OEA believes that at least a short-term restoration of the cost-of-living allowance (COLA) coupled with a decrease in the employee contribution rate is merited. It has taken shared sacrifice of retirees and active employees to greatly improve the funding status. The members and beneficiaries of the system should reap those rewards.

Cheiron, the Board’s actuarial firm, has noted that the pension plan is still vulnerable to adverse experience. Unfunded liabilities are greater than $20 billion and STRS pays out billions more in benefits each year than they collect through contributions. The actuary has recommended that any consideration of benefit improvements should be delayed until after the completion of the five- year experience review (expected in March 2022).

STRS Board Members Pitch Questionable Investment “Partnership”

During the STRS Board’s November meeting, two current Board members presented a “new business opportunity” for STRS. Wade Steen (Governor DeWine’s appointee to the STRS Board) and Rudy Fichtenbaum (a retiree representative) advocated for the creation of a public/private partnership with a firm called QED. Under the proposal the company would facilitate access to STRS assets by a counter party who would execute asset swaps resulting in profits from arbitrage for the counter party.

During a lengthy discussion, it was revealed that QED currently has no assets under management and no track record of performance. Further, STRS would provide 100% of the assets in the “partnership” and receive 25% of the profits. Mr. Steen had previously indicated that he had an investment plan that would return $4 billion in revenue while reducing risk to the portfolio. Based on the discussion, in order to achieve that level of return it would be necessary to devote $65 billion in assets (two-thirds of all STRS assets) to this new enterprise. A proposed motion to hire outside council to negotiate an agreement with QED was never offered

SERS Receives Actuarial Valuation Results

Cavanaugh Macdonald Consulting, SERS’ actuary, presented the results of the fiscal year 2021 actuarial valuation at the SERS Board’s November meeting. The funded status of the pension plan improved from 71.5% to 74.5%. In the actuarial valuation, investment gains are recognized over a four-year period. The funded ratio based on the market value of assets is 82.9%.

Strong investment returns also contributed to extended solvency for the SERS health care fund. The fund is projected to be solvent until 2058. The system’s funding policy allows the Board to allocate up to 0.5% of the employer contribution toward the health care fund if the pension funded ratio is between 70-80%. However, the Board voted to dedicate the full 14% of employer contributions towards basic benefits.

–

OPER Board Lowers Expected Rate of Return Assumption

After hearing the results of a five-year experience study presented by their external actuary, the OPERS Board voted to reduce its assumed rate of return. The change reduced the assumed rate from 7.2% to 6.9%. This was the most impactful among several changes in economic and demographic assumptions of the pension plan.

Assumption changes added almost $2 billion in unfunded liabilities to the plan. The funded ratio was 82.9% as of the last actuarial valuation and the funded ratio would drop to 81.5% based on the changed assumptions.

![]() Click here to download a copy of this December 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this December 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

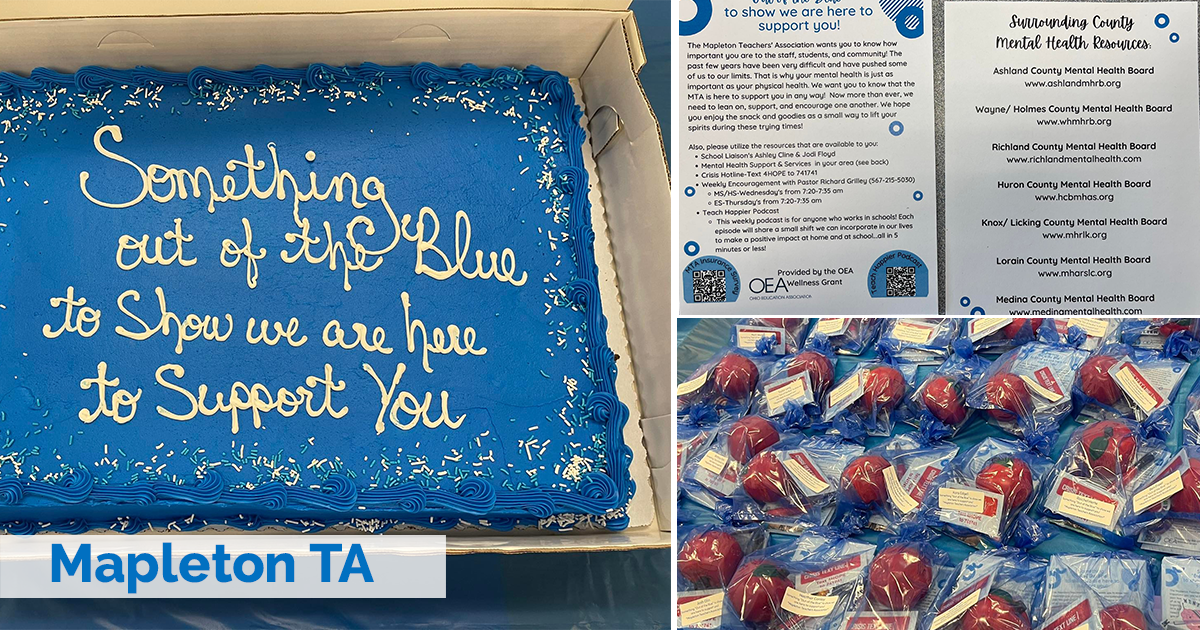

Wellness Grant

OEA’s Wellness Grants Help Locals Support Member Well-Being

- Up to $5/per Active Member

- Submission and Approval of Application Required

- Activity Must be completed between September 3, 2024 – May 31, 2025

- Receipts must be submitted for Reimbursement by June 15, 2025

- Share photos with LRC to post on the OEA Wellness Website

- Contact LRC for Application

- Share your events on social media using #OEAWellnessGrant, #OEAWG, and #OEAWellness

- Click here to download a Wellness Grant application

- Wellness Grants Funds cannot be used for the following: T-shirts, Gift Cards/Gift Certificates, Cash Gifts to Members, or Lottery Tickets

WELLNESS GRANT ACTIVITIES

- Laughter As The Best Medicine – Set a movie event for members. A comedy or light-hearted movie is suggested. Provide members with movie “snacks” as they share an opportunity to laugh alongside fellow members.

- Social Time Members Uplifting Members – Organize an event – perhaps a happy hour or coffee chat – where members can relax and spend time together in a social setting.

- Pop-up Café – Set up a pop-up café that offers members snacks and positive messages. The café could be as simple as a table staffed by other members or a coffee/tea bar.

- Drop-in Spa – Create a drop-in spa for members in buildings. Members can sign up for time to experience a relaxing environment with a massage chair, healthy snacks, and beverages.

- Wellness Passport/Self-Care BINGO – Provide members with a Wellness Passport with pages to be stamped for each self-care activity they do on their own. Create a BINGO card with self-help activities for members to complete. The activities for the passport or BINGO card could include such things as: exercise classes, virtual challenges, book clubs, and meditation. Award members with a gift with a completed passport or completed BINGO card.

- Special Delivery! – Create a monthly drawing for all members. Winners will receive a special delivery of flowers, cookies, candy, self-care bags, or books, and a positive message from their local.

- Lunch and Learn – Invite members to an hourlong lunch and training focused on a wellness activity or skill such as meditation or an art/craft. The lunch hour could include a speaker on a topic related to self-care. Ask members to complete a self-care survey during the lunch and learn.

- Keep Active and Be Healthy Challenges

• Walk/Step Challenge – Provide each member who signs up for the challenge with a promotional Local water bottle, notebook, pen, and information on the health benefits of walking. Create a members-only Facebook or Instagram page for the challenge. Ask participating members to set a personal goal for the 30-day challenge, keep track for 30 days, and post/share positive thoughts via social media.*

• Sleep Challenge – Provide each member who signs up for the challenge with a sleep mask, earplugs, herbal tea, notebook, and information on the health benefits of sleep. Create a members-only Facebook or Instagram page for the challenge. Ask participating members to set a personal goal for the 30-day challenge, keep track for 30 days, and post/share positive thoughts via social media.*

*Members who complete the 30-day challenge receive a certificate and gift - Local’s CHOICE! – Develop a Wellness Themed Activity of your own!

“I got great feedback from some staff that said they appreciated the nice surprise on a cold Monday morning – a goodie bag with items with a note attached explaining how each item can be applied to their own personal wellness”

A sample of locals who have received a Wellness Grant

September 2021 OEA Retirement Systems Update

STRS Posts Investment Return Over 29% for FY 2021

For the fiscal year ending June 30, 2021, STRS reported a net investment return of 29.16%. This figure is net of all management fees, carried interest and other costs. Additionally, the fund beat its investment benchmark by 1.18%. This means that active management of the fund, as opposed to investing solely in index funds, added approximately $790 million (net of costs) over the fiscal year.

This rate of return was the highest for STRS since 1983. STRS total fund assets increased by over $17 billion with a market value of $98.8 billion. This is welcome news as it will increase the long-term stability of the pension fund. Further, OEA believes that as financial conditions improve, STRS should take action to reduce the contribution rate for active teachers and work to restore the cost-of-living adjustment (COLA) for retired teachers.

OEA, in collaboration with the Health Care and Pension Advocates (HPA), urged the STRS Board to establish a plan with clear financial guideposts for restoring benefits. The Board adopted a policy that once the system is 85% funded, they will consider changes that do not materially impair the fiscal health of the pension plan. The annual actuarial valuation in October will show how close this brings the plan to 85% funded.

Walters Appointed to Fill Vacancy on STRS Board

During the August meeting of the STRS Board, Rita Walters was elected by a majority of the Board to fill a vacancy as a retired member. Walters recently completed a four-year term on the Board and had finished third in the election for two retiree seats. Robert Stein, who had finished second in the election, resigned his seat before beginning his new term.

Walters is a retired language arts teacher from the Switzerland of Ohio School District and a member of OEA-R. She was elected by the STRS Board to a one-year term, September 1, 2021 through August 31, 2022. An election will be held among STRS benefit recipients to elect a representative for the remaining three years of the term.

STRS Responds to Seidle Report

Earlier this year, the Ohio Retired Teachers Association (ORTA) commissioned a third-party “forensic audit” of STRS. A report was released by Edward Siedle entitled The High Cost of Secrecy which was critical of STRS investment practices and operations. The report alleged that STRS is not sufficiently transparent in providing information on investment fees and suggests that changes in STRS investment strategies could save money in a way that could help contributing and retired members of the system.

OEA urged the STRS Board to take the Siedle report seriously and fully investigate the claims. Further, OEA asked that STRS communicate openly with its findings, whether deficiencies have been found and what is being done to address them.

On Thursday, August 19, 2021, STRS staff and consultants presented to the Board a detailed response to the Siedle report. The response refuted the claims in the report. STRS notes that the report is not in fact a forensic audit as its author is neither an accountant or auditor and not bound by professional standards. Further, the report overestimates, misstates and miscalculates various fees and performance costs of the system—including double-counting fees on alternative investments. The full response can be viewed here.

OEA has confidence that the elected members of the Board will continue to closely monitor STRS investment practices. Investment returns are the primary driver of paying future pension benefits. Active and retired teachers rely on STRS to invest these assets prudently

SERS Board Passes Motion to Pursue Pension Legislation

On Friday, September 17, 2021, the SERS Board unanimously voted to pursue legislation that would allow the Board to set a Contribution Based Benefit Cap (CBBC). If enacted, the legislation would allow the SERS Board to set a cap on how much greater a member’s pension benefit can be than a single life annuity based on the member’s total contributions. The concept is similar to a policy adopted by OPERS. Such a cap is designed to keep the majority of members from subsidizing benefits of a few members with irregular contribution histories.

SERS staff presented the Board with information on applying a range of CBBC factors. Modeled on recent retirements, a factor of 4.5 would impact 6.3% of retirees whereas a factor of 5 would affect 2.5% of retirees. Those who converted to retirement from a disability benefit would be excluded from such a cap.

The Board motion authorized SERS staff to work with stakeholder groups on the concept and to pursue the introduction of legislation. The Board’s intention is for the legislation to grant them authority to set the CBBC factor rather than setting a number in statute. The discussed timetable was to have something introduced early in 2022.

![]() Click here to download a copy of this September 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this September 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

June 2021 OEA Retirement Systems Update

Correthers, Stein and Fichtenbaum Elected to STRS Board

Two out of three of OEA’s endorsed candidates were re-elected to the STRS Board. In the election of one board member representing active educators, Carol Correthers (OEA endorsed) was re-elected to the Board. In the election of two retiree representatives, Robert Stein (OEA endorsed) was re-elected, and Rudy Fichtenbaum was elected for the first time. Rita Walters, OEA’s other endorsed candidate, finished third in the retiree election.

The results of the active member election were as follows:

Carol Correthers – 7,470 (elected)

Benjamin Pfeiffer – 5,357

Matt Sheridan – 2,877

The results of the retired member election were as follows:

Rudy Fichtenbaum – 21,339 (elected)

Robert Stein – 19,592 (elected)

Rita Walters – 17,114

Elizabeth Jones – 15,926

OEA would like to congratulate the elected members on their victories and thank all members who worked on this election effort and took the time to vote. The new four-year terms on the Board officially begin on September 1, 2021.

SERS Board Discusses Contribution Based Benefit Cap

During the May SERS Board meeting, the Board continued its ongoing discussion of plan sustainability. A large topic of conversation was the notion of a contribution-based benefit cap (CBBC) aimed at addressing spiking concerns. Such a cap would potentially limit a member’s calculated formula benefit if their contribution histories do not adequately support that benefit level. Several examples were given of situations where hypothetical members contribute small amounts over most of their career but have much larger contributions in a few years resulting in an inflated benefit. Utilizing a CBBC would place an upper limit of annual benefit based annuitizing accumulated contributions and interest and multiplying by a factor to set a benefit cap. The examples presented to the Board illustrated factors of 5 or 6 times the annuitized contributions.

The use of a CBBC is still in the exploration phase but Board members expressed some interest in preventing spiking to keep the majority of members from subsidizing others. There was also discussion of a tiered benefit formula that would have a lower multiplier in the early years of a member’s career and a higher multiplier later. This was discussed as a potential way to reward career service.

![]() Click here to download a copy of this June 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this June 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

May 2021 OEA Retirement Systems Update

SERS Changes Actuarial Assumptions, Lowers Assumed Rate of Return

SERS Changes Actuarial Assumptions, Lowers Assumed Rate of Return

On the advice of its actuarial consulting firm, the SERS Board voted to change the actuarial assumptions for the SERS pension and health care plan during its April meeting. Changes were made to the economic and demographic of the plans. The actuaries recommended lowering the inflation assumption from 3.00% to 2.40%. This change was the primary driver of the recommendation to lower the assumed rate of return from 7.50% to 7.00%. The lower assumed rate added nearly $185 million to SERS unfunded liabilities.

Other changes to the economic assumptions included a decrease in the payroll growth assumption from 3.50% to 1.75% and a reduction of the assumed increase in the cost-of-living adjustment (COLA) from 2.5% to 2.0%. Changes to demographic assumptions (retirement and withdrawal rates, mortality, etc.) were also made based on SERS plan experience. The SERS Board voted unanimously to adopt all of the actuary’s recommended changes.

Despite the drop in the assumed rate of return for the pension plan, the funding status of the system was projected to drop only slightly to 70.87% funded with a period of 26 years to pay off the unfunded liabilities. The Board also voted to raise the assumed rate of return for the health care plan to 7.00% from 5.25%. This contributed to a projected increase in the funding status of the health care fund to just over 38% funded.

STRS Reviews Proposed Changes for Health Care Plan

At the April STRS Board meeting, staff presented several proposed changes to the STRS health care plan for calendar year 2022. The proposed changes are designed to have a positive impact on premiums to offset expected rate increases.

The proposed changes include: decreasing maximum out-of-pocket limits on prescriptions to $5,100 from $6,500 for the Medicare plans; fully funding hospital coverage for Medicare enrollees with Part B-only; changes to formularies to provide greater rebates; and reducing the copay for some specialty drugs.

The STRS Board is expected to vote on these proposed changes at its May meeting. Staff will also provide an initial look at 2022 health care premiums at that time

![]() Click here to download a copy of this May 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.

Click here to download a copy of this May 2021 Report to the OEA Board of Directors. Previous Retirement Systems Updates can be viewed under the Affiliate Resources tab on the OEA website.